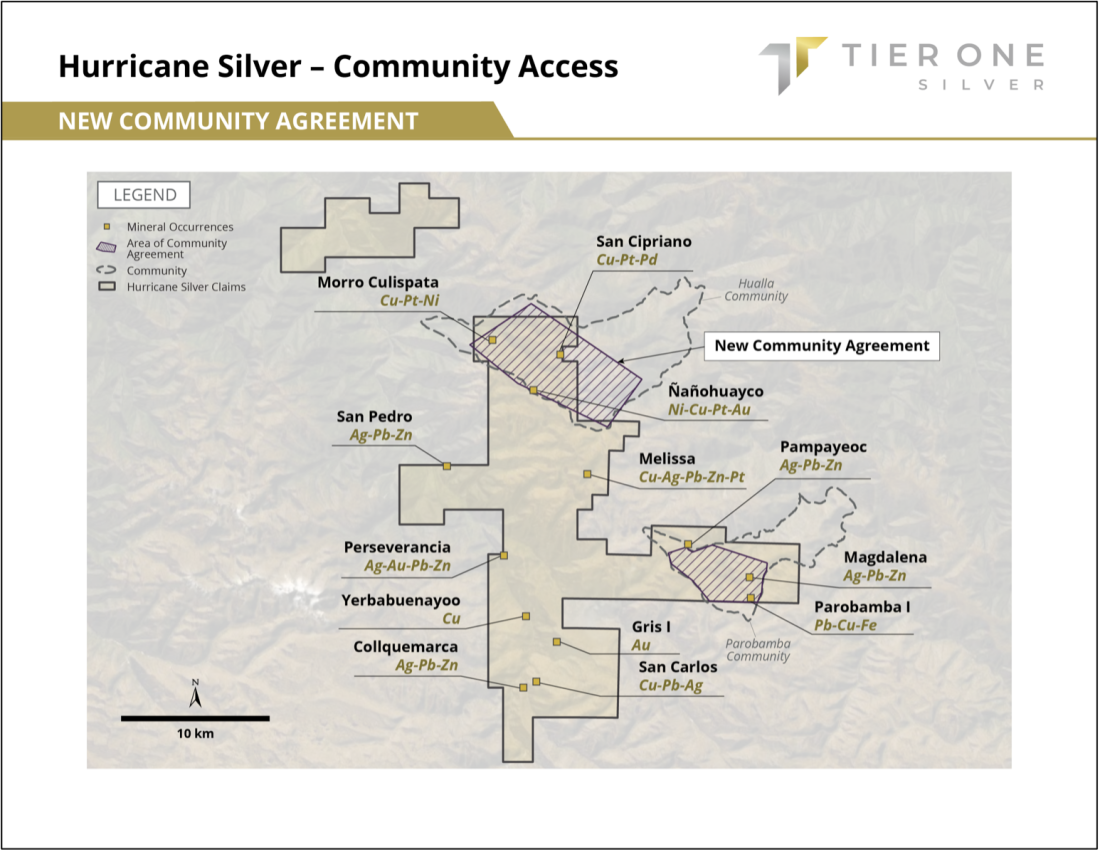

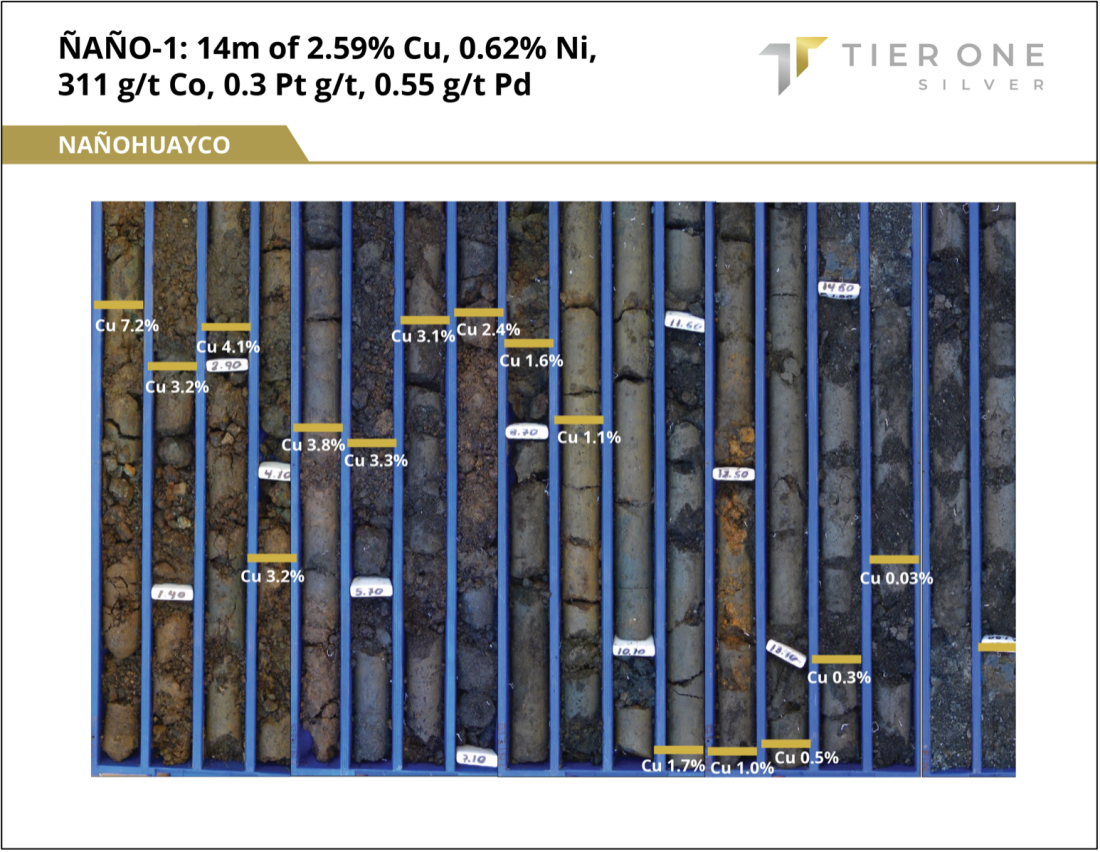

Vancouver, Canada – May 19, 2022 – Tier One Silver Inc. (TSXV: TSLV, OTCQB: TSLVF) (“Tier One” or the “Company”) is pleased to announce that it has gained additional social access at the Hurricane Silver project, located approximately 65 kilometres (km) north of the city of Cusco. A social agreement has been signed with the Hualla community, which will allow for exploration of the Ñañohuayco, San Cipriano and Morro Culispata copper-nickel-platinum-palladium-silver prospects (Figure 1). The agreement is valid for two years and allows the Company to conduct surface work as well as drilling once a drill permit has been obtained from the Peruvian Ministry of Energy and Mines. Historical work at the Ñañohuayco and San Cipriano prospects included surface sampling, ground-based geophysical surveys and initial drill tests by the previous operator from 2009 – 2010. The 10-hole 1,061 metre (m) historical drill program at Ñañohuayco included 14 m of 2.59% copper, 0.62% nickel, 311 g/t cobalt, 0.3 g/t platinum and 0.55 g/t palladium (Figures 2 – 3).

A Message from Peter Dembicki, President, CEO & Director:

“Access to Ñañohuayco allows us to begin exploration at a high priority target at our Hurricane Silver project. The historical intercepts from the target demonstrate significant grade, and there has been minimal exploration, so we look forward to following up. Over the coming months we will work to further define targets at Hurricane Silver as we get ready to resume drilling at Curibaya.”

Geological and Historical Exploration Overview:

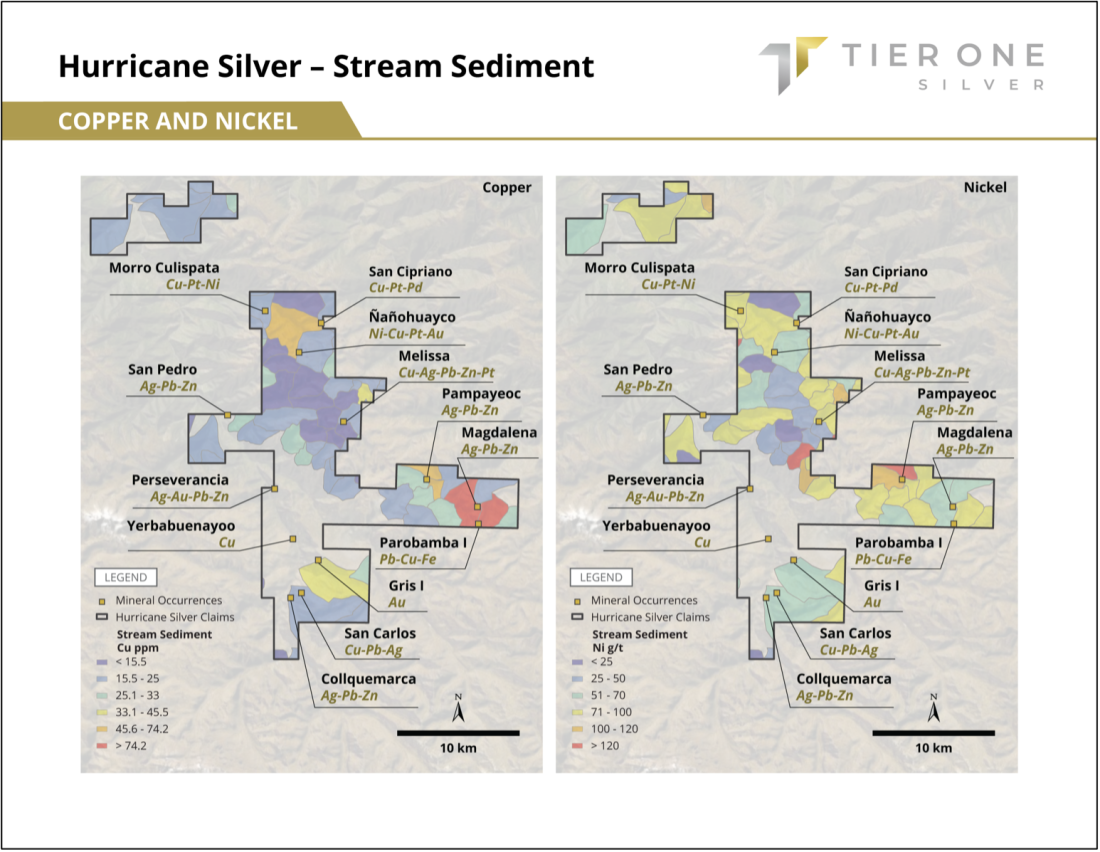

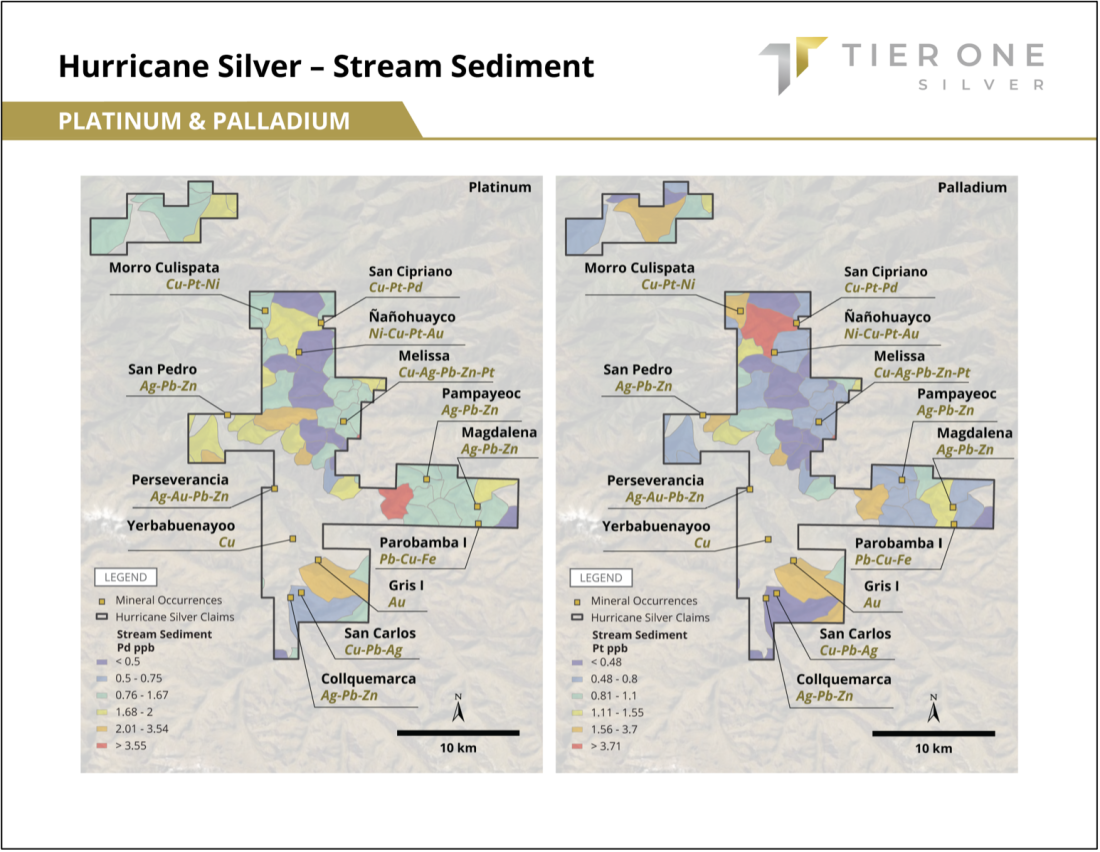

Geologically, the copper-nickel-platinum-palladium magmatic sulphide mineralization observed at the Hurricane Silver project is associated with Permo-Triassic rifting and the emplacement of ultramafic intrusives within the Pisco-Albancay deflection of southern Peru. The district was initially assembled based on the results of a high-quality stream sediment survey undertaken in 2007 – 2009, when anomalous copper, nickel, platinum and palladium drainage values were identified (Figures 4 – 5).

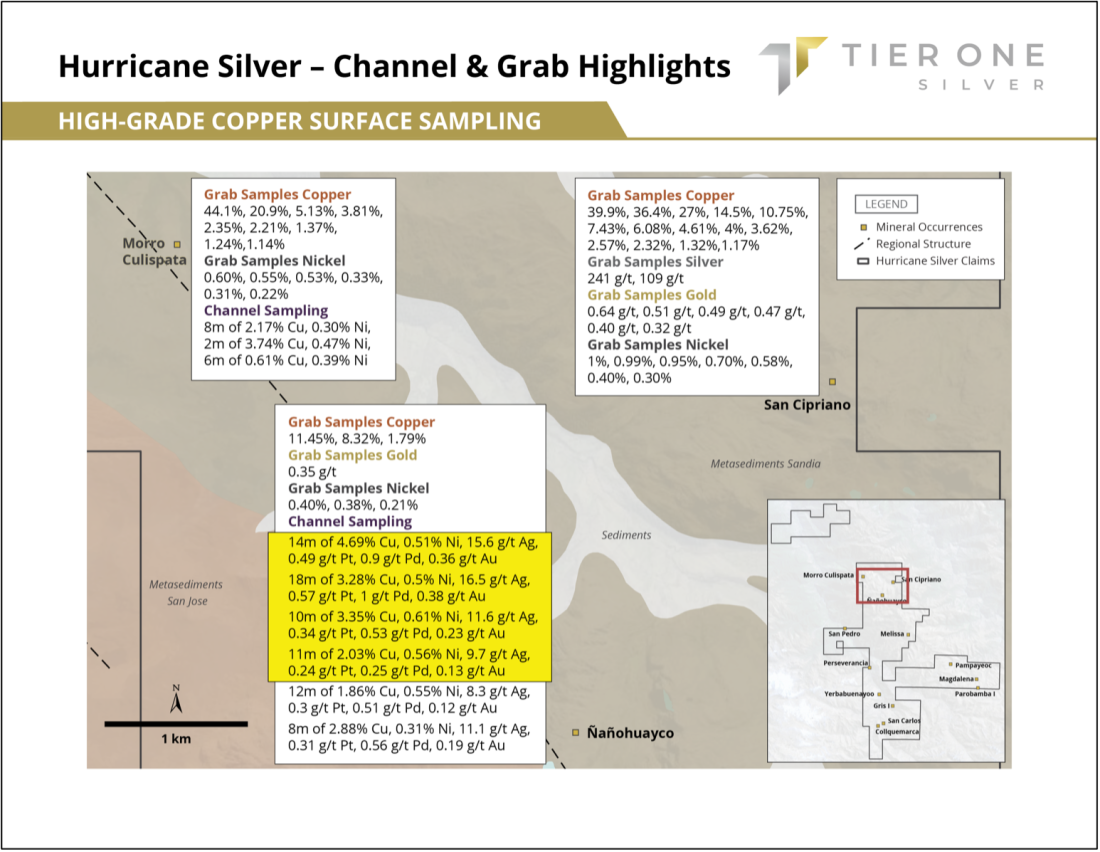

The northern region of the Hurricane Silver district, where social access has been obtained, is characterized by the Ñañohuayco, San Cipriano and Morro Culispata copper-nickel-platinum-palladium occurrences. Limited surface work has been conducted in these areas, with rock chip and channel sampling demonstrating the high-grade potential of the mineralized systems. Highlights from historical channel sampling at Ñañohuayco include 14 m of 4.69% copper and 0.51% nickel, 18 m of 3.28% copper and 0.50% nickel and 10 m of 3.35% copper and 0.61% nickel (Figure 6). Highlights from channel sampling at Morro Culispata include 8 m of 2.17% copper and 0.3% nickel and 2 m of 3.74% copper and 0.47% nickel (Figure 6). Table 1 below presents highlights from historical channel sampling.

Table 1 Historical Channel Sampling:

|

Area |

Trench ID |

Length (m) |

Cu |

Ni |

Co |

Pt |

Pd |

Au |

Ag |

|---|---|---|---|---|---|---|---|---|---|

|

Ñañohuayco |

NANT-12 |

14 |

4.69 |

0.51 |

241 |

0.49 |

0.90 |

0.36 |

15.6 |

|

NANT-11 |

18 |

3.28 |

0.50 |

215 |

0.57 |

1.00 |

0.38 |

16.5 |

|

|

NANT-10-1 |

10 |

3.35 |

0.61 |

280 |

0.34 |

0.53 |

0.23 |

11.6 |

|

|

NANT-10-2 |

11 |

2.03 |

0.56 |

219 |

0.24 |

0.25 |

0.13 |

9.7 |

|

|

NANT-03 |

12 |

1.86 |

0.55 |

230 |

0.30 |

0.51 |

0.12 |

8.3 |

|

|

NANT-05 |

8 |

2.88 |

0.31 |

105 |

0.31 |

0.56 |

0.19 |

11.1 |

|

|

NANT-06 |

8 |

2.77 |

0.33 |

145 |

0.26 |

0.58 |

0.18 |

10.0 |

|

|

NANT-13 |

10 |

2.61 |

0.42 |

146 |

0.20 |

0.27 |

0.13 |

9.0 |

|

|

NANT-09-1 |

14 |

1.66 |

0.55 |

220 |

0.29 |

0.41 |

0.21 |

10.1 |

|

|

NANT-09-2 |

5 |

2.24 |

0.45 |

232 |

0.33 |

0.41 |

0.20 |

8.3 |

|

|

NANT-01 |

19 |

1.00 |

0.58 |

290 |

0.15 |

0.19 |

0.05 |

3.9 |

|

|

NANT-02 |

8 |

1.31 |

0.41 |

210 |

0.17 |

0.94 |

0.07 |

6.2 |

|

|

NANT-04 |

16 |

1.79 |

0.39 |

142 |

0.28 |

0.46 |

0.21 |

8.8 |

|

|

NANT-07 |

7 |

1.73 |

0.31 |

129 |

0.21 |

0.30 |

0.12 |

8.1 |

|

|

NANT-08 |

6 |

1.39 |

0.34 |

139 |

0.20 |

0.38 |

0.15 |

8.5 |

|

|

NANT-14 |

6 |

1.53 |

0.22 |

113 |

0.14 |

0.16 |

0.09 |

6.1 |

|

|

Morro Culispata |

xCul-01 |

8 |

2.17 |

0.30 |

156 |

0.05 |

0.04 |

0.04 |

3.4 |

|

xCul-05 |

2 |

3.74 |

0.47 |

459 |

0.02 |

0.03 |

0.03 |

4.8 |

|

|

xCul-03 |

6 |

0.61 |

0.39 |

294 |

0.02 |

0.02 |

0.02 |

1.6 |

|

|

xCul-06 |

2 |

3.81 |

0.12 |

69 |

0.03 |

0.03 |

0.03 |

6.0 |

|

|

xCul-02 |

10 |

0.61 |

0.28 |

151 |

0.02 |

0.02 |

0.03 |

2.7 |

|

|

xCul-04 |

8 |

0.67 |

0.21 |

120 |

0.03 |

0.02 |

0.04 |

2.8 |

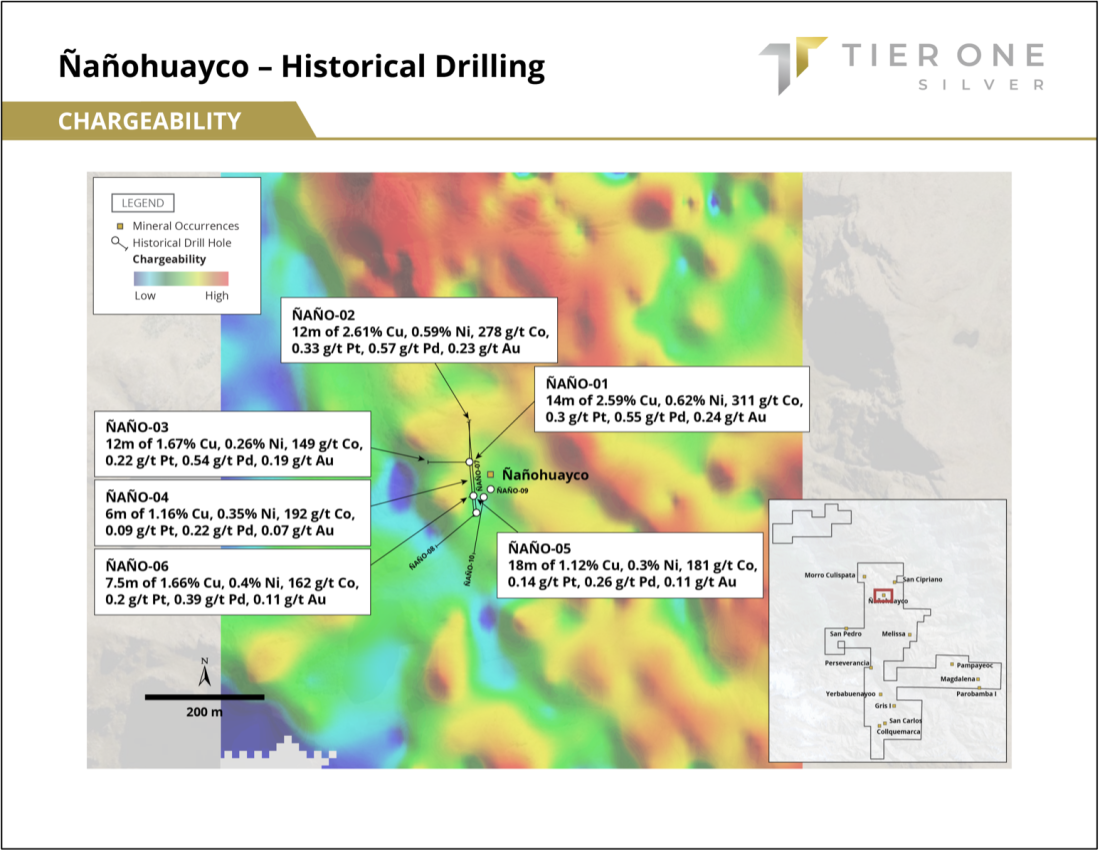

The first-pass drill programs at Ñañohuayco and San Cipriano totaled 10 drill holes over 1,061 m and 11 holes over 1,722 m, respectively. These historical drill programs targeted flat lying ultramafic sills with highlighted results listed below in Tables 2 and 3. Importantly, at both Ñañohuayco and San Cipriano there are untested chargeability and conductivity anomalies that the Company’s technical team believes have the potential to correspond to copper-nickel-platinum-palladium magmatic sulphide style of mineralization.

Table 2 Historical Drill Results, Ñañohuayco prospect:

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Cu(%) |

Ni (%) |

Co (g/t) |

Pt (g/t) |

Pd (g/t) |

Au (g/t) |

|---|---|---|---|---|---|---|---|---|---|

|

ÑAÑO-01 |

0 |

14 |

14 |

2.59 |

0.62 |

311 |

0.30 |

0.55 |

0.24 |

|

ÑAÑO-02 |

0 |

12 |

12 |

2.61 |

0.59 |

278 |

0.33 |

0.57 |

0.23 |

|

ÑAÑO-03 |

0 |

12 |

12 |

1.67 |

0.26 |

149 |

0.22 |

0.54 |

0.19 |

|

ÑAÑO-04 |

2.3 |

8.3 |

6 |

1.16 |

0.35 |

192 |

0.09 |

0.22 |

0.07 |

|

ÑAÑO-05 |

0 |

18 |

18 |

1.12 |

0.30 |

181 |

0.14 |

0.26 |

0.11 |

|

ÑAÑO-06 |

0 |

7.5 |

7.5 |

1.66 |

0.40 |

162 |

0.20 |

0.39 |

0.11 |

Table 3 Historical Drill Results, San Cipriano prospect:

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Cu(%) |

Ag (g/t) |

Pt (g/t) |

Pd (g/t) |

Au (g/t) |

|---|---|---|---|---|---|---|---|---|

|

SCI-06 |

0 |

5.7 |

5.7 |

0.22 |

69.5 |

2.54 |

1.52 |

1.69 |

Exploration Plan Phase 1:

The Company will look to expand on the positive historical exploration work at the Ñañohuayco, San Cipriano and Morro Culispata prospects and to evaluate new target areas through geological mapping, soil sampling, rock and channel sampling and additional ground-based geophysical surveys. The Company’s goal is to identify the ultramafic source areas to the mineralized sub-horizontal sills that have been identified historically.

Figure 1: Illustrates the area of the social agreement with the Hualla community that will allow for exploration of the Ñañohuayco, San Cipriano and Morro Culispata copper-nickel-platinum-palladium prospects.

Figure 2: Includes images of historical drill core from the Ñañohuayco prospect with an intercept of 14 m of 2.59% copper, 0.62% nickel, 311 g/t cobalt, 0.3 g/t platinum and 0.55 g/t palladium.

Figure 3: Illustrates the historical ten-hole drill program at the Ñañohuayco prospect with highlighted results.

Figure 4: Illustrates anomalous copper and nickel drainage basins based upon a high-quality stream sediment survey conducted between 2007 and 2009.

Figure 5: Illustrates anomalous platinum and palladium drainage basins based upon a high-quality stream sediment survey conducted between 2007 and 2009.

Figure 6: Illustrates highlights from historical selective rock chip and channel sampling from the Ñañohuayco, San Cipriano and Morro Culispata prospects.

Christian Rios (SVP of Exploration), P.Geo, is the Qualified Person who has reviewed and assumes responsibility for the technical contents of this press release.

ON BEHALF OF THE BOARD OF DIRECTORS OF TIER ONE SILVER INC.

Peter Dembicki

President, CEO and Director

For further information on Tier One Silver Inc., please contact Natasha Frakes, Vice President of Communications at (778) 729-0600 or [email protected].

About Tier One

Tier One Silver is an exploration company focused on creating value for shareholders and stakeholders through the discovery of world-class silver, gold and base metal deposits in Peru. The Company’s management and technical teams have a strong track record in raising capital, discovery and monetization of exploration success. The Company’s exploration assets in Peru include: Hurricane Silver, Coastal Batholith, Corisur and the flagship project, Curibaya. For more information, visit www.tieronesilver.com.

Cautionary Note Regarding Historical Drilling, Grab, Chip and BLEG Samples and Related Matters:

Hurricane Historical Drilling (2010)

Historical drill samples were taken by sawing HQ diameter core into equal halves on site with one half being sent to ALS lab in Arequipa, Peru for preparation and then to Lima, Peru for analysis. Preparation included crushing core samples to 70% < 2mm and pulverizing 250 g of crushed material by more than 85% < 75 microns. All samples were assayed using 30 g nominal weight fire assay with ICP-MS finish for gold, platinum and palladium (PGM-MS23). Where MS23 results were > 1 g/t Au, Pt or Pd the assays were repeated with ore grade 30 g nominal weight fire assay with ICP-AES finish (PGM-ICP27). Silver and base metals were analyzed as part of the multi-element aqua regia digest ICP-AES/ICP-MS method (ME-MS41). Where MS41 results were greater than 10,000 ppm Cu or 100 ppm Ag the assays were repeated with ore grade aqua regia digestion with AA finish (Cu-AA46 and Ag-AA46, respectively).

The historical grab, chip and BLEG samples from the Hurricane Silver project were collected by Compania de Exploraciones Orion SAC (2007-2009), a Pembrook Copper affiliate, and were included in a database obtained in connection with the transaction. Given the time interval, Tier One Silver has not assessed the validity of the QA/QC protocols that were followed in the collection of these samples. Accordingly, readers are cautioned about reliance on the accuracy or repeatability of this sampling. Sampling is of very limited geological significance and serves only to assist in the development of a methodical exploration program involving geochemical, geophysical and ultimately, diamond bit drill core drilling. There is no known mineral resource of commercial interest established at the Hurricane Silver project.

The historical grab, chip and stream sediment samples from the Hurricane Silver project were collected by Compania de Exploraciones Orion SAC (2007-2009). Tier One Silver has not conducted any due diligence on whether appropriate QA/QC protocols were followed in the collection of these samples, nor can it confirm their accuracy or repeatability.

Grab and Chip Samples

Approximately 3-5 kg of material was collected for analysis and sent to ALS Lab in Lima, Peru for preparation and analysis. All samples were assayed using 30 g nominal weight fire assay. Platinum and paladium were analyzed by ICP and MS (PGM-MS23); gold was analyzed by ICP and AES finish (Au-ICP21). For samples assaying above 10 ppm from ICP21 the assays were repeated with 30 g nominal weight fire assay with gravimetric finish (Au-GRA21). Silver and base metals were analyzed as part of the multi-element package (ME-MS41), or to trace levels in 36 multi-element package (ME-ICP41). In 2009, silver analysis was completed by 30 g fire assay with gravimetric finish (Ag-GRA21). Where MS41, ICP41 results were greater than 10,000 ppm Cu, 10,000 ppm Zn, 10,000 ppm Pb or 100 ppm Ag the assays were repeated with ore grade aqua regia digestion with AA finish (Cu-AA46; Zn-AA46; Pb-AA46; Ag-AA46, respectively).

Stream Sediment Samples

Approximately 0.25 kg of -80 mesh material was collected for analysis by sieving in the field and sent to the ALS Lab in Lima, Peru for preparation and analysis. Samples from regional BLEG survey are analyzed using fire assay with ICP finish (Au-ICP21) and ultra-trace multi-element aqua regia digest ICP-AES/ICP-MS method (ME-MS41L).

Forward Looking Information and General Cautionary Language

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements”) that relate to the Company’s current expectations and views of future events. are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be heavily relied upon. These statements speak only as of the date of this news release. In particular and without limitation, this news release contains forward-looking statements in regard to the Company’s financing plans.

Readers should refer to the risks discussed in the Company's Annual Information Form and Management’s Discussion & Analysis for the year ended December 31, 2021, and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release