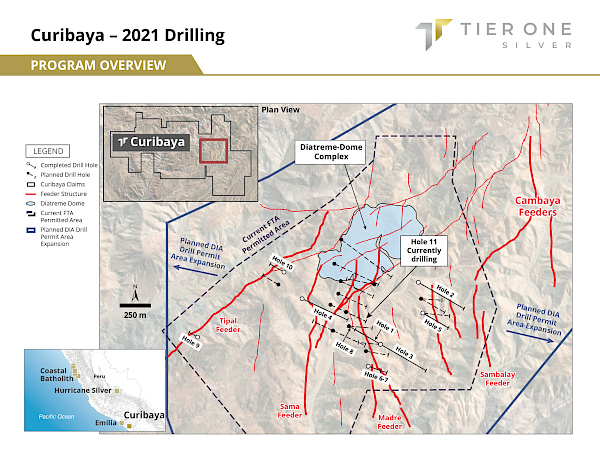

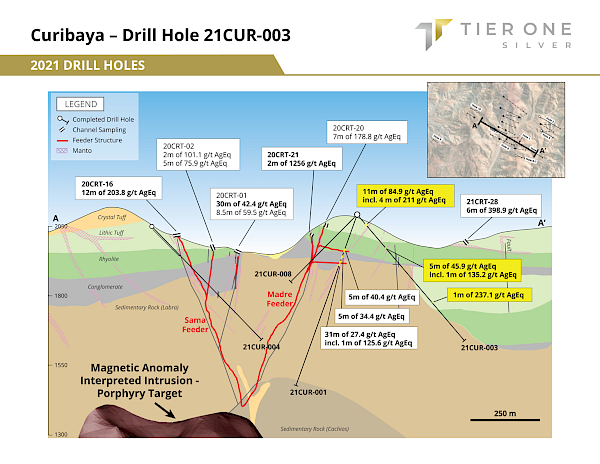

Vancouver, Canada – November 4, 2021 – Tier One Silver (TSXV: TSLV, OTCQB: TSLVF) (“Tier One” or the “Company”) is pleased to provide results from drill holes 2 and 3, both of which were drilled prior to recent targeting advancements that are based on newly identified feeder structures and channel sample results (Figure 1). Drill hole 3 intersected several zones of mineralization with intercepts including 4 metres (m) of 211 g/t silver equivalent (AgEq), within a broader interval of 11 m of 84.9 AgEq near surface, and 1 m of 237.1 AgEq (Table 1). The precious metal mineralization was encountered approximately 50 m into the footwall of the Madre vein feeder structure from the same pad as hole 1 but drilled in the opposite direction (Figure 2).

A Message from Peter Dembicki, President, CEO & Director:

“Hole 3 has strengthened our model, which confirms the Madre vein feeder is the defined corridor that potentially hosts the high-grade silver in the southern portion of Curibaya. These results, combined with the recently produced spectral analysis and previous geophysical data, are proving to be a key targeting mechanism. We have observed our best veining in subsequent holes across the Madre corridor and feeder, which is currently being drilled and has results pending.”

Table 1: Summary of Significant Results from Drill Holes 2-3

|

Hole ID |

|

From |

To |

Length |

AgEq |

Ag |

Au |

Zn |

Pb |

|---|---|---|---|---|---|---|---|---|---|

|

21CUR-002 |

|

No significant results |

|||||||

|

21CUR-003 |

|

43 |

54 |

11 |

84.9 |

68.8 |

0.21 |

0.003 |

0.02 |

|

Incl. |

50 |

54 |

4 |

211.0 |

173.8 |

0.50 |

0.003 |

0.03 |

|

|

|

155 |

160 |

5 |

45.9 |

24.0 |

0.05 |

0.250 |

0.16 |

|

|

Incl. |

159 |

160 |

1 |

135.2 |

68.5 |

0.04 |

0.756 |

0.73 |

|

|

|

413 |

414 |

1 |

237.1 |

147.0 |

0.10 |

0.995 |

0.93 |

|

|

Main intervals - AgEq (Ag,Au,Zn,Pb) at 25ppm (minimum 5m, max consecutive dilution 6m); Sub-intervals - AgEq (Ag,Au,Zn,Pb) at 75ppm (minimum 1m, max consecutive dilution 2m) |

|||||||||

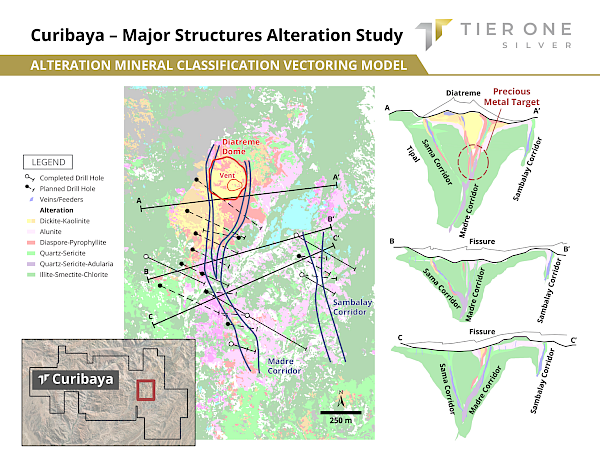

Targeting along the Madre feeder structure has been advanced through a recently completed field and remote sensing short wave infrared (SWIR) alteration mineral study that has clearly defined a 1.4 kilometre (km) north – south trending corridor (Figure 3). The hyperspectral study has proven to be a major advancement toward the targeting of high-grade precious metal mineralization by providing distinct vertical and lateral exploration vectors based on the mapping of alteration minerals associated with epithermal-style precious metal mineralization. The Company has now further refined its drill targeting based on the results of the hyperspectral study to target along newly defined alteration corridors, including the Madre and Sambalay feeder structures. In particular, the Company is targeting where these feeder structures are crossing the central dome and diatreme complex where proven Ag-Au mineralization is encountered in veinlet arrays and vuggy silica from recent rock chip sampling. The advanced argillic alteration associated with mineralization on the diatreme-dome complex suggests the potential for a complete mineralized precious metal – hydrothermal system extending to depth below the diatreme-dome complex. Future planned drill holes will utilize the results of the hyperspectral study along with rock and channel sample results to target both the Madre and Sambalay feeder structures.

A Message from Dave Smithson, SVP of Exploration:

“The new spectral understanding that at least two of the five recognized feeders at Curibaya are oriented north-south is a large step forward for ongoing targeting. For the first time, we have been able to connect spectral corridors with the best veins drilled and trenched to-date toward the diatreme-dome complex. This opens up new potential to test for good vein widths in the precious metal window below the diatreme-dome complex, which is the focus for the remainder of the current program.”

Advancement of Drill Targeting:

The purpose of the recently completed hyperspectral study was to clearly define potential precious metal drill targets based on the mapping of alteration minerals across the project. The study used 3319 field Spectrometer measurements across the drill permitted area to calibrate World View 3 satellite imagery that provides 2.4 m resolution of alteration minerals across the project area. The results of the study to-date show two clearly defined north – south trending prospective precious metal corridors along the 1.4 km Madre vein and the 900 m Sambalay vein feeder structures. These structures are defined by the presence of quartz veins with sericite-alunite grading laterally to illite-smectite-chlorite. The structures trend under the central diatreme-dome complex, which Tier One’s technical team believes is the potential source for precious metal mineralization across the property. The dome is spectrally-defined by an assemblage of kaolinite-dickite-pyrophylite-diaspore and vuggy silica mapped high on the dome demonstrating the potential along these feeder structures. This alteration geometry is consistent with epithermal mineralization models and the potential for high grade veins and precious metal mineralized structures associated with quartz – sericite and quartz – adularia alteration at depth.

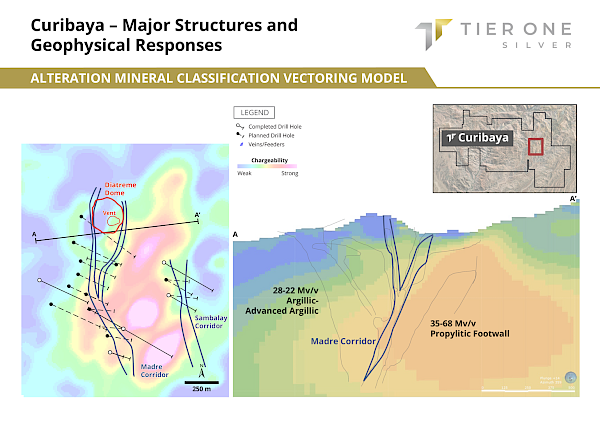

Another important advancement in drill targeting is the recognition of the strong spatial correlation between spectrally-defined propylitic alteration and the large-scale induced polarization (IP) chargeability anomaly that the Company was targeting in the first three drill holes. Results from the first three drill holes have enabled Tier One’s technical team to establish that high chargeability responses correspond to propylitic alteration associated with finely disseminated pyrite. Critically, the Madre and Sambalay feeder structures are aligned along the margins of the high chargeability zones, further strengthening the Company’s drill targeting efforts (Figure 4). The next drill holes have been reoriented to target the gradient, along the edges of the high chargeability feature, where it trends under the dome-diatreme complex (Figure 4).

To-date, the Company has drilled 11 holes for a total of 3,970 m at the Curibaya project with results pending for eight drill holes.

Figure 1: Illustrates the ongoing drill program, the location of the holes and their proximity to interpreted feeder structures. The planned expansion for the drill permit will allow the Company to drill the new target areas in 2022.

Figure 2: Illustrates the location and results of drill hole 3 at the Curibaya project, which encountered precious metal mineralization approximately 50 m into the footwall of the Madre vein feeder structure from the same pad as hole 1 but drilled in the opposite direction.

Figure 3: Illustrates findings from a recently completed field and remote sensing short wave infrared (SWIR) alteration mineral study that has clearly defined a 1.4 km north - south trending corridor along the Madre feeder structure and a 900 m corridor along the Sambalay feeder structure, further strengthening the Company’s drill targeting efforts.

Figure 4: Illustrates the high chargeability responses, which Tier One’s technical team believes correspond to spectrally-defined propylitic alteration. Critically, the Madre and Sambalay feeder structures are aligned along the margins of the high chargeability zones. The next drill holes have been reoriented to target the gradient, along the edges of the high chargeability feature, where it trends under the dome-diatreme complex.

Michael Henrichsen (Chief Geologist), P.Geo is the QP who assumes responsibility for the technical contents of this press release.

ON BEHALF OF THE BOARD OF DIRECTORS OF TIER ONE SILVER INC.

Peter Dembicki

President, CEO and Director

For further information on Tier One Silver Inc., please contact Natasha Frakes, Vice President of Communications at (778) 729-0600 or [email protected].

About Tier One

Tier One Silver is an exploration company focused on creating value for shareholders and stakeholders through the discovery of world-class silver, gold and base metal deposits in Peru. The Company’s management and technical teams have a strong track record in raising capital, discovery and monetization of exploration success. The Company’s exploration assets in Peru include: Hurricane Silver, Emilia, Coastal Batholith, Corisur and the flagship project, Curibaya, which has commenced its first drill program. For more information, visit www.tieronesilver.com.

Curibaya Drilling

Analytical samples were taken by sawing HQ or NQ diameter core into equal halves on site and sent one of the halves to ALS Lab in Arequipa, Peru for preparation and then to Lima, Peru for analysis. All samples are assayed using 30 g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10,000 ppm Cu, 10,000 ppm Pb or 100 ppm Ag the assay were repeated with ore grade four acid digest method (Cu, Pb, Ag-OG62). Where OG62 results were greater or near 1,500 ppm Ag the assay were repeated with 30 g.

QA/QC programs for 2021 core samples using company and lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed.

Silver equivalent grades (AgEq) were calculated using silver price of US$18/oz, gold price of US$1,300/oz, zinc price of US$1.25/lb, and lead price of US$1.00/lb. Metallurgical recoveries were not applied to the silver equivalent calculation.

Intercepts were calculated with no less than 5 m of >= 25 g/t AgEq with maximum allowed consecutive dilution of 6 m.

True widths of mineralization are unknown based on current geometric understanding of the mineralized intervals.

Forward Looking Information and General Cautionary Language

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements”) that relate to the Company’s current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result”, “are expected to”, “expects”, “will continue”, “is anticipated”, “anticipates”, “believes”, “estimated”, “intends”, “plans”, “forecast”, “projection”, “strategy”, “objective” and “outlook”) are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release. In particular and without limitation, this news release contains forward-looking statements regarding the Company’s exploration plans.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.