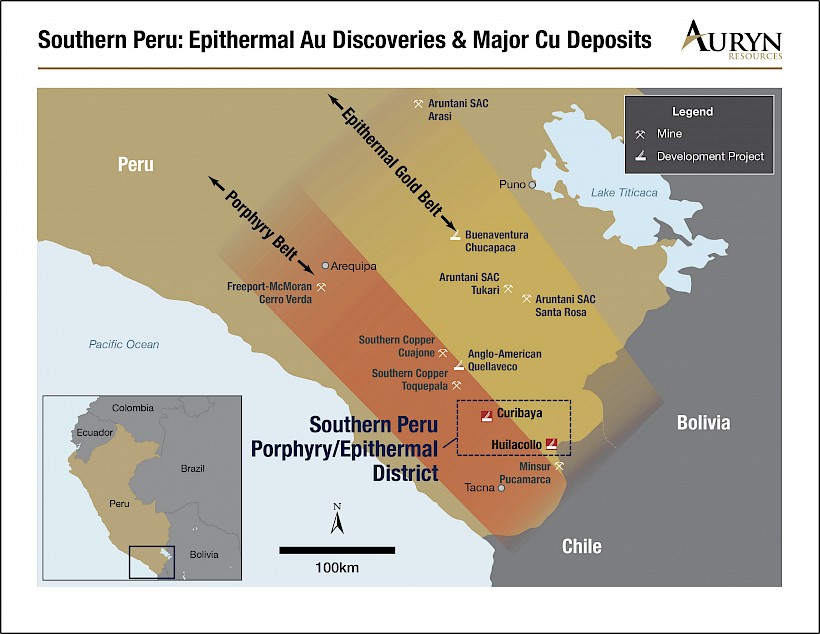

Vancouver, British Columbia – June 2nd, 2016 – Auryn Resources Inc. (TSX-V: AUG, OTCQX: GGTCF “Auryn” or the “Company”) is pleased to announce that it has acquired the rights, through two separate transactions, to the Huilacollo and Curibaya properties in the Tacna province of Southern Peru. Together these projects encompass a total of 33,600 hectares within the prolific Pliocene Au/Ag epithermal and Miocene Cu/Au porphyry belts. The epithermal belt in this region of Peru is host to four multi-million ounce gold discoveries since the year 2000 and the porphyry belt is host to four of the largest porphyry deposits in Peru (see figures 1 & 2).

Shawn Wallace, President and CEO, commented, “Our acquisitions in Peru are largely predicated on our technical teams vast knowledge and experience in the country. Huilacollo represents an oxide gold, discovery stage project with significant exploration opportunities that can be explored year round.”

Mr. Wallace further stated, “With these acquisitions in Peru and others that we are still pursuing, our goal of building a diverse portfolio with some of the worlds highest grade exploration targets in Canada and some of the largest scalable oxide exploration projects in Peru is being achieved.”

The Huilacollo Property

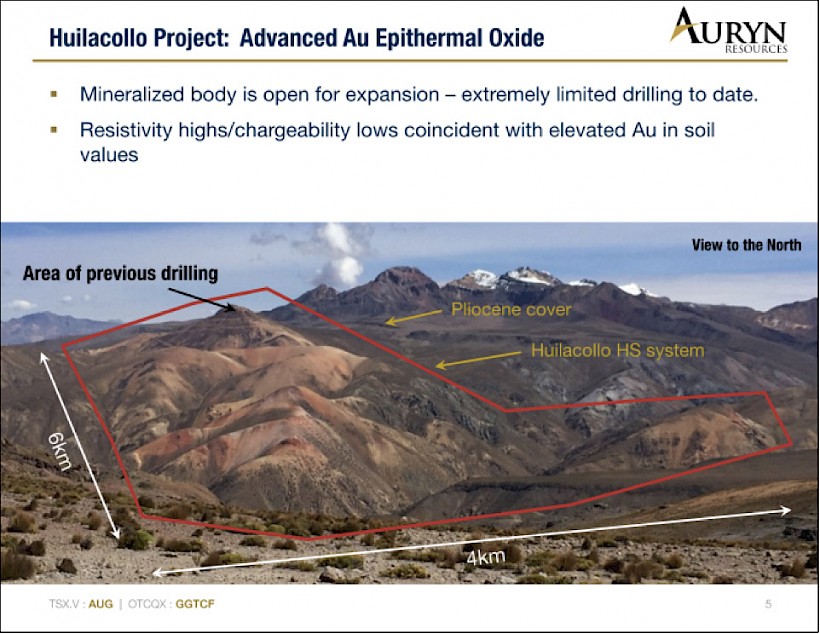

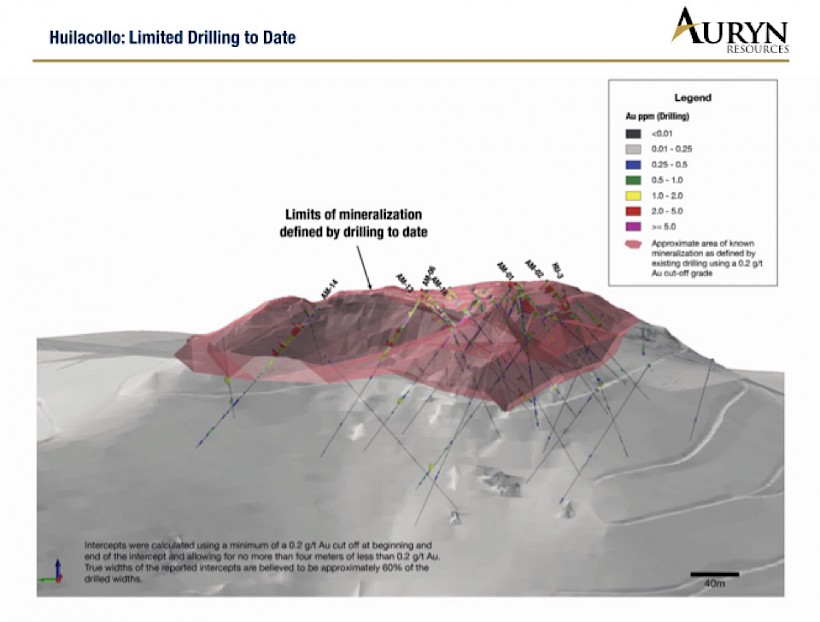

The Huilacollo epithermal property is comprised of 2,000 hectares of intense hydrothermal alteration that is consistent with epithermal Au/Ag mineralization over a 4 by 6 km area (see figure 3). Historical drilling has outlined a mineralized zone (see figure 4) that is open for expansion along a 4km north-south trending corridor. Table 1 below highlights historical intercepts:

| Table 1: Huilacollo selected intercepts |

||||||

| Hole_ID | From | To | Interval | Au g/t | Ag g/t | Au g/t*meters |

| AM-14 | 0 | 82.5 | 82.5 | 1.16 | 6.5 | 95.6 |

| AM-13 | 0 | 62 | 62 | 0.94 | 12.1 | 58.1 |

| AM-13 | 128 | 146 | 18 | 1.04 | 4.3 | 18.7 |

| AM-06 | 0 | 88 | 88 | 1.05 | 9.0 | 92.1 |

| AM-16 | 0 | 82 | 82 | 0.99 | 18.5 | 80.9 |

| AM-01 | 0 | 80 | 80 | 1.29 | 11.8 | 103.2 |

| AM-02 | 0 | 50.65 | 50.65 | 1.24 | 9.3 | 63.0 |

| HU-3 | 5.45 | 39.45 | 34 | 2.14 | 22.1 | 72.9 |

| Intercepts were calculated using a minimum of a 0.2 g/t Au cut off at beginning and end of the intercept and allowing for no more than four meters of less than 0.2 g/t Au. True widths of the reported intercepts are believed to be approximately 60% of the drilled widths. | ||||||

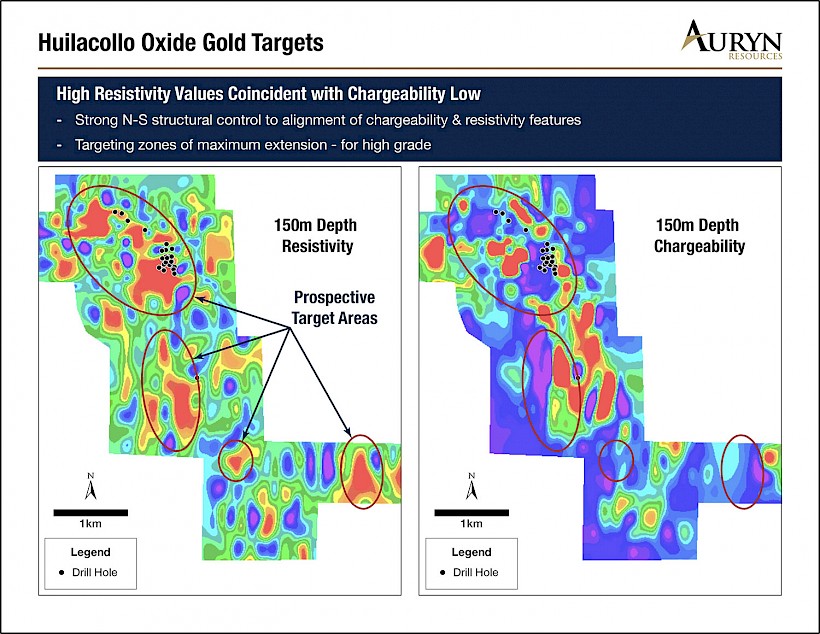

Higher grade zones within the mineralized zone appear to be focused along well defined feeder structures as highlighted by trench intercepts up to 38m at 6.7g/t Au and drill holes including 34m @ 2.14g/t. Importantly, the mineralization as currently defined, represents less than 10% of the area of first order geophysical targets defined by overlapping high resistivity and low chargeability zones that represent the potential for oxide gold mineralization within silica bodies (see figure 5). Initial exploration work will focus on rapidly establishing drill targets through structural mapping, trenching, volumetric sampling, and multi-spectral analysis with an initial drill program planned for the fourth quarter of 2016.

Huilacollo has excellent infrastructure with access by road, nearby high voltage power lines and water.

The Company acquired the rights to the Huilacollo property through an option agreement with a local Peruvian company, Inversiones Sol S.A.C. (the “Huilacollo Option”). Under the Huilacollo option, the Company may acquire a 100% interest, subject to a NSR, through a combination of work expenditures and cash payments as detailed in the table below:

| Due dates | Property Payments | Work Expenditures |

| All amounts in US dollars | ||

| Effective Date (May 31, 2016) | $ 250,000 | - |

| Within 24 months of the Effective Date | $ 500,000 | $ 2,000,000 |

| Within 36 months of the Effective Date | - | $ 3,000,000 |

| Within 48 months of the Effective Date | $ 250,000 | - |

| Within 60 months of the Effective Date | $ 250,000 | $ 2,000,000 |

| Within 72 months of the Effective Date | $ 7,500,000 | - |

| Total | $ 8,750,000 | $ 7,000,000 |

The Huilacollo NSR is 1.5% and buyable for $2,500,000 on precious metals and 2.5% buyable for $7,000,000 on base metals.

The Curibaya Property

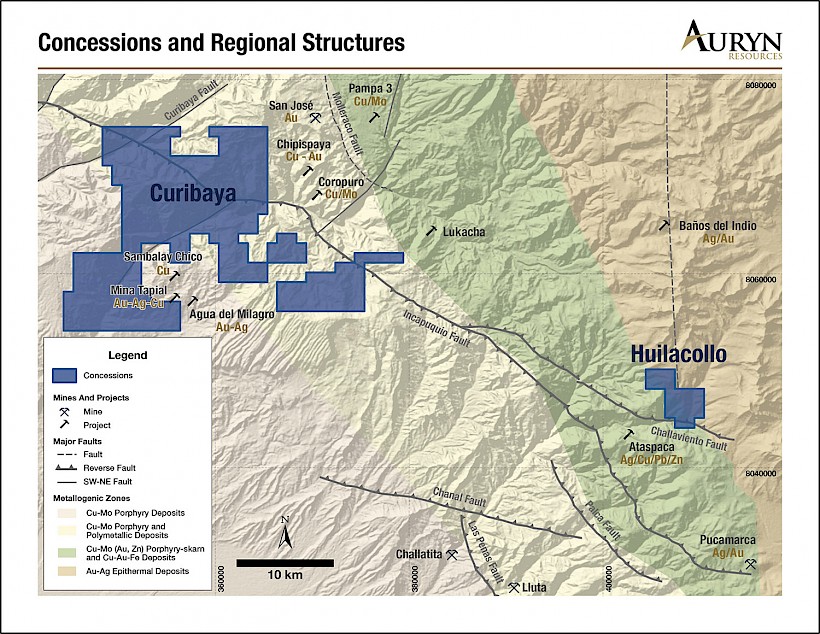

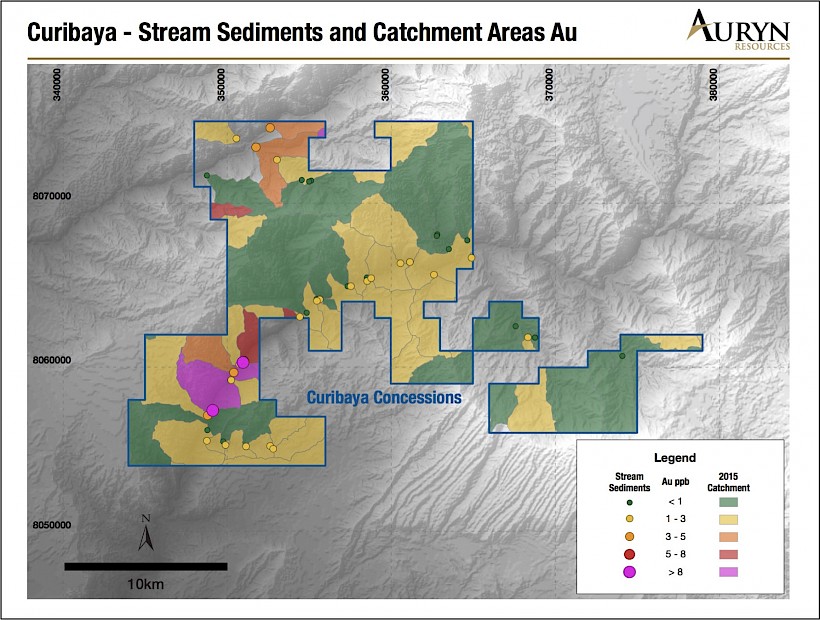

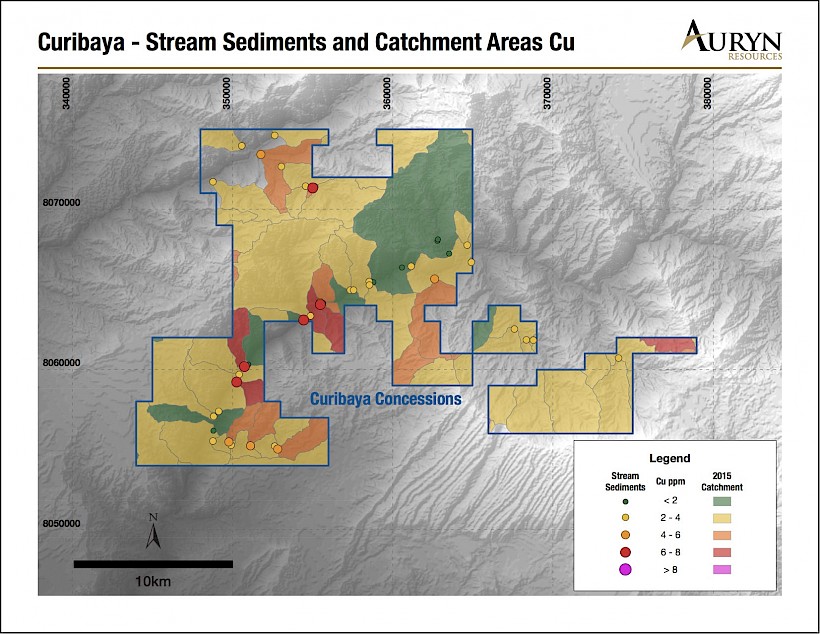

The Curibaya property comprises of 31,600 hectares covering the regional Incapuquio fault zone and subsidiary structures that are collectively interpreted as one of the fundamental controls for both epithermal and porphyry styles of mineralization within the region. Importantly the licenses host a number of cross structures to the Incapuquio fault zone that are considered highly prospective (figure 2). Auryn has undertaken an initial exploration program that consisted of a cyanide leach stream sediment survey that has identified a cluster of gold & copper anomalies in contiguous drainage basins within the SW portion of the claim block spanning an area of approximately 50 square kilometers (see figures 6 and 7). These anomalies are the first stage of developing Cu/Au porphyry and Au epithermal targets.

The Company acquired 100% ownership in the Curibaya property through direct staking and the national auction process. The total cost to acquire the licenses was approximately $200,000.

Michael Henrichsen (Chief Operating Officer), P.Geo is the QP who assumes responsibility for the technical contents of this press release.

About Auryn Resources: Auryn Resources is a junior mining exploration company focused on delivering shareholder value through project acquisition and development. The Company’s management team is highly experienced with an impressive track record of success in the discovery, development, financing and monetizing of mining assets for shareholders.

Forward Looking Information

This release includes certain statements that may be deemed “forward-looking statements”. Forward-looking information is information that includes implied future performance and/or forecast information including information relating to, or associated with, exploration and or development of mineral properties. These statements or graphical information involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company to be materially different (either positively or negatively) from any future results, performance or achievements expressed or implied by such forward-looking statements.

Disclaimer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1: Location of Curibaya and Banos del Indio licenses within the southern Peru epithermal and porphyry belts

Figure 2: Structural setting of the Curibaya and Huilacollo licenses with highlighted projects in the vicinity

Figure 3: Huilacollo 4 by 6 km high sulphidation alteration system as outlined by the red polygon

Figure 4: Huilacollo historical drilling highlighted

Figure 5: Huilacollo oxide gold targets defined by coincident high resistivity and low chargeability signatures. Note very limited drilling in target areas

Figure 6: Illustrates anomalous gold bearing drainages within the Curibaya concessions

Figure 7: Illustrates anomalous copper bearing drainages within the Curibaya concessions